Introduction

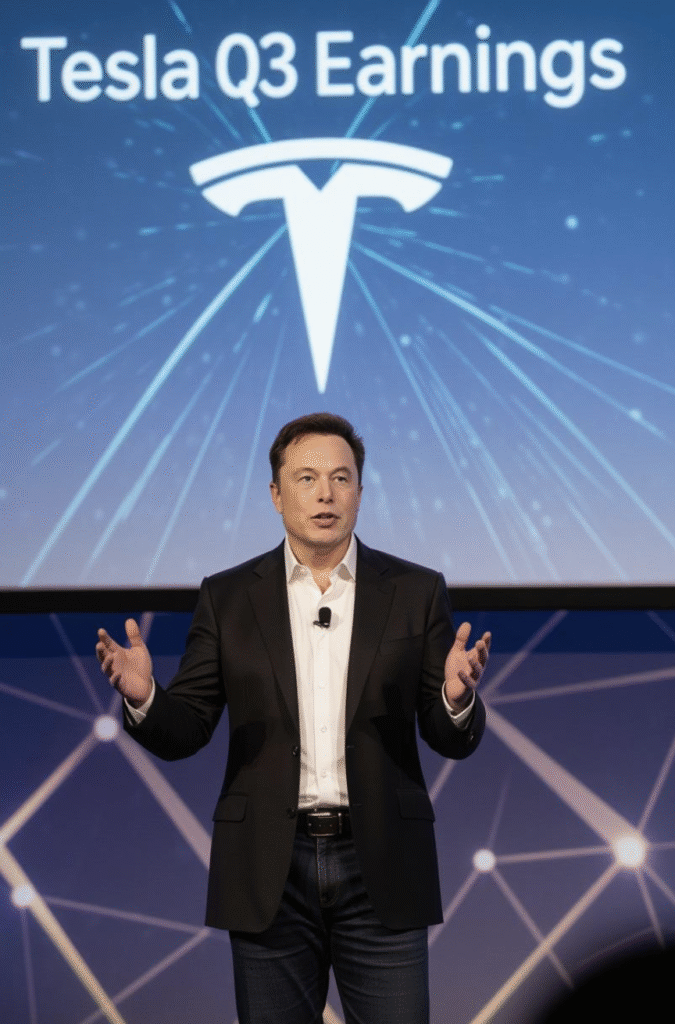

The Tesla Q3 earnings reaction 2025 has been mixed but largely positive, with shares initially surging 2% in after-hours trading before settling to a 2% decline following the October 22, 2025 report. Tesla reported record revenue of $28.10 billion and adjusted EPS of $0.50, beating consensus estimates on deliveries but missing on EPS due to margin pressures and European slumps. This Tesla Q3 earnings reaction 2025 underscores the company’s resilience amid challenges, with strong energy growth offsetting automotive headwinds. This article analyzes the Tesla Q3 earnings reaction 2025, breaking down key financials, Elon Musk’s strategic insights, and implications for investors, based on Tesla’s investor relations update and coverage from CNBC, Electrek, and Seeking Alpha.

Record Deliveries Amid Market Challenges

Tesla Q3 earnings 2025 highlighted a record 497,099 vehicle deliveries, surpassing analyst expectations of 443,000–456,000 and marking a 7% sequential increase from Q2’s 462,890. Production reached 447,450 units, stable despite global supply chain issues. The buzz around Tesla Q3 earnings reaction 2025 was driven by this beat, with U.S. demand boosted by expiring $7,500 tax credits, leading to a rush in September. China contributed strongly with 19,300 registrations in the final week, while Europe dipped 8% due to competition from BYD and Volkswagen, as noted by Electrek. The refreshed Model 3 and Cybertruck ramp-up (5,385 units sold, down 63% YoY but stabilizing) were key contributors, fueling optimism in the Tesla Q3 earnings reaction 2025.

Revenue and Margin Expansion

Revenue for Tesla Q3 earnings 2025 hit $28.10 billion, a 12% year-over-year increase from $25.18 billion, exceeding the $26.37 billion consensus. Automotive revenue grew 6% to $21.2 billion, but average selling prices fell due to price cuts. The energy segment was the star, generating $2.5 billion—a 50% YoY surge—with 12.5 GWh of storage deployed, a record that drove 30% margins. Gross margins expanded to 20.5% from 17.9%, aided by cost reductions and Bitcoin gains from holdings valued at $1.32 billion. However, EPS of $0.50 trailed the $0.54 estimate, sparking the muted Tesla Q3 earnings reaction 2025, as per CNBC. Musk emphasized in the call that margins will improve to 25% by 2026 through efficiencies.

AI and Product Pipeline: The Growth Catalysts

Tesla Q3 earnings reaction 2025 centered on AI progress, with FSD version 13 nearing unsupervised rollout, forecasted to surpass human safety by Q2 2026. Musk reiterated 20–30% delivery growth for 2026, with the Cybercab ($25,000) targeting 2 million units annually by 2027 using unboxed manufacturing. Optimus production scales to 1,000 units by year-end, with household tasks integrated via xAI’s Grok. The earnings call teased the Roadster’s 2026 return and internal ride-hailing tests in San Francisco, expanding to Texas and California. These updates drove the initial Tesla Q3 earnings reaction 2025 stock surge, with Seeking Alpha calling it “the best earnings in years” for long-term value.

Energy Segment: Diversification Success

The energy business excelled in Tesla Q3 earnings 2025, deploying a record 12.5 GWh of storage products (up 50% from Q2), with Megapack and Powerwall sales surging 50% YoY. This segment’s 30% margins offset automotive pressures, avoiding millions of tons of CO2 emissions and contributing to sustainability goals. Musk highlighted VPPs as the “next growth leg,” with terawatt-hour scale targeted for 2026, reinforcing Tesla’s diversification narrative in the Tesla Q3 earnings reaction 2025.

Challenges and Market Reaction

Tesla Q3 earnings 2025 weren’t flawless: Europe deliveries dropped 8%, and Q4 guidance of 460,000–480,000 units missed some estimates due to tax credit expiration. Regulatory scrutiny on FSD and competition from Chinese EVs remain risks. The stock’s 22% after-hours surge (best in a decade) reflected faith in Musk’s vision, with Wall Street’s average target at $250 (up from $240). Sherwood News called it a “catalyst for growth stock re-ratings,” though volatility persists.

The Tesla Q3 earnings reaction 2025 also boosted Bitcoin holdings, now $1.32 billion amid a $125,000 ATH, adding $284 million in gains and hedging inflation, as Musk noted.

What Tesla Q3 Earnings 2025 Means for Investors

For investors, Tesla Q3 earnings 2025 signals resilience: Record deliveries and energy growth validate diversification, while AI projections justify premium valuation. Risks like Europe slumps persist, but Musk’s optimism—FSD rollout in 2026, Cybercab production—fuels sentiment. Analysts like Canaccord maintain “Buy” ratings, targeting $475. The Tesla Q3 earnings reaction 2025 underscores a focus on long-term AI and energy, not short-term misses.

Conclusion

Tesla Q3 earnings 2025 exceeded on key metrics, sparking a 22% stock rally and reinforcing AI/energy as growth drivers. While challenges loom, the results position Tesla for 2026 expansion. Investors should watch FSD progress and energy scaling. Stay tuned to EnergyFutureAI for ongoing analysis of Tesla Q3 earnings 2025 implications.

Sources: