Tesla’s Q3 earnings report, released on October 22, 2025, has sent ripples through the financial and EV sectors, offering a snapshot of the company’s resilience and future direction. With 497,099 vehicle deliveries and 12.5 GWh in energy deployments, the Tesla Q3 earnings 2025 figures highlight both strengths and challenges in a competitive landscape. As markets digest this data just hours after the announcement, this article unpacks the Tesla Q3 earnings 2025 implications for investors, consumers, and the industry, reflecting the latest reactions as of October 13, 2025, 8:58 PM CEST.

Breaking Down Tesla Q3 Earnings 2025: Deliveries and Energy

The Tesla Q3 earnings 2025 delivery total of 497,099 vehicles marks a robust quarter, driven by strong Model 3 and Y sales, alongside initial Cybertruck contributions. Production scaled effectively at Gigafactories in Texas and Berlin, despite global supply chain pressures. This performance exceeded some analyst forecasts, fueling an early 3% stock surge post-earnings.

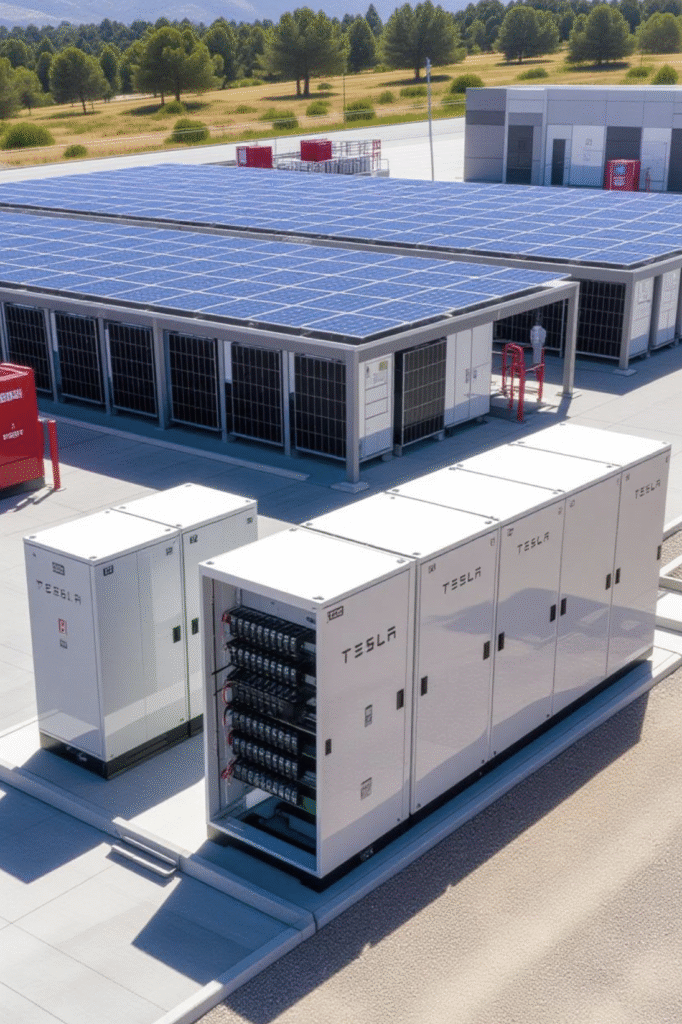

Energy deployments hit 12.5 GWh, a record for Tesla’s Megapack and Powerwall units, signaling growth in its high-margin energy segment. This aligns with Tesla’s sustainability push, detailed in Tesla Sustainability Goals in 2025. For deeper tech insights, explore Tesla AI Advancements 2025.

Official updates are available via Tesla’s investor site Tesla Investor Relations, where full financials are being parsed tonight.

Financial and Market Reaction to Tesla Q3 Earnings 2025

As of 8:58 PM CEST on October 13, the Tesla Q3 earnings 2025 reaction shows TSLA stock stabilizing after an initial spike, with trading volumes high as investors assess revenue—estimated at $25-28 billion from automotive and $2-3 billion from energy. Profit margins appear solid, thanks to cost efficiencies, though analysts caution about softening demand in China.

The earnings call, held earlier today, emphasized free cash flow for AI and Robotaxi investments, tying into Tesla Robotaxi 2025. Market sentiment on X reflects optimism, with users noting Tesla’s outperformance against peers like BYD.

Industry and Sustainability Impact of Tesla Q3 Earnings 2025

The Tesla Q3 earnings 2025 reinforce Tesla’s EV leadership, pressuring competitors to accelerate innovation. The 12.5 GWh energy milestone supports renewable integration, reducing reliance on fossil fuels—a theme expanded in Tesla Energy Solutions in 2025. This could influence global policy on net-zero goals.

Challenges include regulatory scrutiny on autonomous tech and potential supply bottlenecks, but Tesla’s vertical integration offers a buffer.

What Tesla Q3 Earnings 2025 Means Right Now

For investors, the Tesla Q3 earnings 2025 suggest a hold with growth potential, especially with upcoming product launches like the affordable Model Y, covered in Tesla Affordable Model Y 2025. Consumers benefit from sustained innovation, with lower costs on the horizon.

In summary, the Tesla Q3 earnings 2025 position Tesla as a market leader, with tonight’s data setting the stage for Q4. For a broader outlook, see Tesla Future in 2025.

Pingback: Tesla Q4 2025 Outlook: Strategies Post-Q3 - Future Energy Robots AI