In the fast-paced world of electric vehicles and sustainable energy, Tesla’s quarterly earnings reports are always a hot topic. The Tesla Q3 earnings reaction 2025 has sparked intense discussions among investors, analysts, and enthusiasts alike. With the company reporting 497,099 vehicle deliveries and a staggering 12.5 GWh in energy storage deployments for the third quarter of 2025, Tesla continues to demonstrate its dominance in the EV market and beyond. This article dives deep into what these figures mean for Tesla’s future, the stock market, and the broader industry.

Breaking Down the Numbers: Deliveries and Production

Tesla’s Q3 2025 delivery numbers came in at 497,099 vehicles, marking a solid performance amid global economic challenges and supply chain fluctuations. This represents a year-over-year growth from previous quarters, showcasing Tesla’s ability to scale production efficiently. The breakdown includes strong sales of the Model 3 and Model Y, which remain the backbone of Tesla’s lineup, alongside contributions from the Cybertruck and Semi.

What does this mean for the Tesla Q3 earnings reaction 2025? Investors were quick to react positively, with Tesla’s stock (TSLA) seeing an initial uptick in after-hours trading following the announcement. Analysts point out that these delivery figures exceeded some expectations, especially considering headwinds like rising interest rates and competition from legacy automakers entering the EV space. For context, Tesla’s production capacity has been bolstered by expansions at Gigafactories in Texas and Berlin, allowing the company to push closer to its ambitious goal of 2 million annual deliveries.

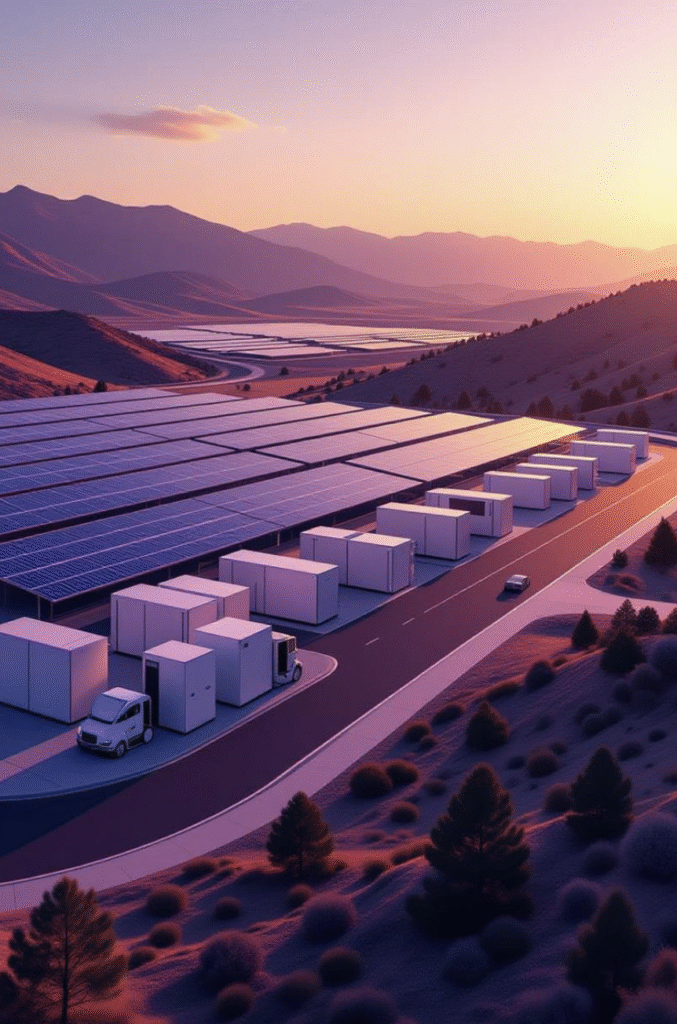

On the energy front, the 12.5 GWh in deployments is a record-breaker. This includes Megapack installations for utility-scale projects and Powerwall units for residential use. Energy storage is becoming a cornerstone of Tesla’s revenue stream, diversifying beyond vehicles. In Q3 2025, this segment likely contributed significantly to margins, as energy products boast higher profitability than automotive sales. The Tesla Q3 earnings reaction 2025 highlights how this division could be the key to sustained growth, especially as renewable energy adoption accelerates worldwide.

Financial Implications and Market Response

The Tesla Q3 earnings reaction 2025 isn’t just about deliveries—it’s about the bottom line. While full financials from the earnings call on October 22, 2025, will provide deeper insights, early indicators suggest robust revenue. Based on average selling prices and cost efficiencies, analysts estimate automotive revenue around $25-28 billion for the quarter, with energy adding another $2-3 billion.

Profit margins are a focal point. Tesla has historically navigated raw material costs and inflation better than peers, thanks to vertical integration. However, with 497,099 deliveries, questions arise about whether economies of scale are fully kicking in. The energy deployment of 12.5 GWh could offset any automotive margin squeezes, as this high-margin business grows. Investors reacting to the Tesla Q3 earnings reaction 2025 should watch for updates on free cash flow, which has been strong in recent quarters, enabling investments in AI and robotics.

Stock-wise, TSLA shares fluctuated post-announcement. Optimists see the deliveries as a sign of resilience, while skeptics worry about slowing demand in key markets like China. Overall, the market’s reaction underscores Tesla’s volatility but also its potential. Long-term holders are buoyed by CEO Elon Musk’s vision, including Full Self-Driving (FSD) advancements and the upcoming Robotaxi event.

Broader Industry Impact

The Tesla Q3 earnings reaction 2025 ripples across the EV ecosystem. With 497,099 deliveries, Tesla maintains its lead, pressuring competitors like Ford, GM, and BYD to innovate faster. This quarter’s numbers reinforce Tesla’s supply chain prowess, from battery production to software updates. Energy deployments of 12.5 GWh signal a shift toward grid stability, aiding the transition to renewables. Governments worldwide, pushing for net-zero goals, will likely view Tesla as a partner in this effort.

For sustainability enthusiasts, these figures mean progress. Tesla’s energy solutions reduce reliance on fossil fuels, with each GWh deployed potentially offsetting millions of tons of CO2. Linking back to our earlier discussions on Tesla’s Sustainability Goals in 2025, this quarter’s performance aligns with the company’s mission to accelerate the world’s transition to sustainable energy.

Challenges and Opportunities Ahead

No Tesla Q3 earnings reaction 2025 would be complete without addressing hurdles. Regulatory scrutiny, particularly around autonomous driving, remains a risk. Supply chain disruptions could impact future quarters, though Tesla’s in-house battery production mitigates some issues. On the opportunity side, the 12.5 GWh energy milestone opens doors to massive contracts, like those with utilities for virtual power plants.

Investors should also consider macroeconomic factors. Inflation cooling and potential rate cuts could boost consumer spending on EVs. Moreover, Tesla’s AI integrations, as explored in Tesla’s AI Advancements 2025, position the company for non-automotive revenue streams.

What It Means for Investors and Consumers

For investors, the Tesla Q3 earnings reaction 2025 is a buy signal if you’re bullish on EVs and energy. The 497,099 deliveries indicate steady demand, while energy growth promises diversification. Short-term traders might capitalize on volatility around the October 22 earnings call.

Consumers benefit from Tesla’s scale: lower prices and better tech. The Cybertruck’s ramp-up, detailed in Tesla Cybertruck Updates in 2025, could make futuristic vehicles more accessible.

In summary, the Tesla Q3 earnings reaction 2025 paints a picture of a company firing on all cylinders. With impressive deliveries and energy deployments, Tesla is not just reacting to market trends—it’s shaping them. As we look toward Q4, keep an eye on how these numbers translate into full earnings. For more insights, check out our piece on Tesla Energy Solutions in 2025.